An ‘AMA’ with the Tsinghua International Blockchain Association

We were recently invited to take part in an ‘Ask Me Anything’ with the blockchain folk at Tsinghua University — Here’s the full transcript!

“Saito has a transient chain. How can it be a blockchain when the ledger isn’t permanent?” — Julian

Richard Parris: The ‘genesis block can be moved forward over time so long as the process for doing so is in the consensus layer. People can keep records going back as far as they like – including all the hashes of previous blocks. This lets the chain stay a sustainable size, while important data can be rebroadcast, forever, if desired.

David Lancashire: Permanent ledgers are transient, because they get big and collapse. Look at BCH and BSV — people are already straight-up admitting the network won’t store data and asking people to pay separately for that. Saito guarantees immutability for as long as people have money to pay for it. That is what matters. Anything else is a bait-and-switch. Right now people are paying for “forever” and network nodes are deleting as soon as they can get away with it.

“What are ‘incentive mechanisms’ in blockchain?” — Peter G

Richard Parris: The genius of bitcoin is that it was the first network in human history that could autonomously pay for its own survival. This is only possible because of incentives. If a miner leaves, another will join. Their incentive to do so is the block reward and the transaction fees. At Saito we believe that incentives are critical not just to ensuring people secure the network but also run nodes and do the heavy lifting of moving transactions.

David Lancashire: Blockchains get what they pay for. POW pays for hashing so we get a lot of that. POS pays for staking. But we don’t want hashing or staking. We want the network to deliver value for users. Paying for actual “value” isn’t something that POW or POS can do, which is one reason there are so many debates about how to get “decentralization” or “funding for development”. With the proper incentive mechanisms in place, the network will get everything it needs. Saito does that, because it incentivizes people to collect fees (i.e. deliver value to users)

“How do you define a successful blockchain? What are the most important challenges for becoming a successful blockchain?”— Wang

Richard Parris: To me a successful blockchain is one that maintains open access and is useful. Scaling is critical in this. This is the biggest challenge we take on at Saito, and why we concentrate so hard on paying the network for the work, read value, it brings to users.

“Where is the line where keeping the blockchain network secure costs too much that the efficiencies of centralization are more worthwhile, and how does this calculation differ across the various industries (e.g. energy, finance)?” — Michael

David Lancashire: Two thoughts here.

1. All blockchains are secured by transaction fees. Bitcoin miners will not spend more money on energy that they collect in fees, for instance, which is why we need massive throughput for security. Saito also allocates 100% of fees to securing the network (there is no 51% attack).

2. Also — Saito does not have the problem you describe — paying more for bandwidth can increase decentralization and security and throughput simulateously! The idea that “centralization” is acceptable because it provides “security” is something that people say because they don’t know how to achieve both. It isn’t true.

“With some EU countries banning Libra and rumors about China getting more strict about mining, are you optimistic about the regulatory environment of blockchain businesses? How do all these affect Saito?” — Elyas

Richard Parris: I am optimistic about the regulatory environment. I think governments are tightening up on cryptocurrencies, definitely. This has two important effects. It clarifies the situation for people working on all kinds of blockchain projects. It also makes access to crypto much more important. From our perspective, we are seeing much more enlightened regulation from smaller nation states: Switzerland, Malta, Singapore… as this gives them a commercial advantage, I hope this extends to other countries.

“Is Chinese regulation on crypto making it more complicated to implement Blockchain solutions in China versus other countries?” — Karim

David Lancashire: I’m torn on China. Being in China is a huge liability on the ideas-front if you aren’t in the Chinese establishment or connected to the government. We’ve had people dismiss us because they think everything in China is a scam. So being here makes it harder to get people to take us seriously. On the other hand, we have a lot of leeway in being able to *do* stuff since no-one in China really cares about anything that is flying below the radar.

On the positive side, our networking code got decent pretty quickly just because of having to handle firewall issues.

“Besides finance, what other industries do you see the most potential for blockchain in the short term?” — Ana Deveza

Richard Parris: The obvious candidates for Blockchain are Fintech, Logistics/Transport, Ticketing and Collectibles. These are all great areas. But the big uses for blockchain will be as a general use public key infrastructure. This will be useful in decentralizing, and creating level playing fields in areas like IoT and Social Media.

“Blockchain has the potential to solve problems such as trust — what are some less obvious/well-known problems that blockchain has created, or you foresee blockchain to create in the future?” — Yuqian

David Lancashire: Great question. Most blockchains just want to be money and everyone thinks “applications” need smart contracts to run. But I think this will be maybe 5% of all blockchain applications in the future. Let me give some examples of what is coming:

1. With Saito everyone can communicate without Man-In-The-Middle Attacks. This is a huge deal because we can use the blockchain to do things like “diffie-hellman key exchanges” and eliminate all of these centralized chat applications. So wechat and telegram and instagram are endangered because — screw that — we can just send a message on the blockchain saying, “this is my IP address” and our friends can connect to us that way.

2. Centralized web applications like Facebook, Yelp, and Twitter are also threatened because their entire business model is locking down content and forcing people to watch advertising. On Saito advertisers give you tokens directly and applications are decentralized. So there is no Facebook.

3. In Saito-class networks routers in the network make money. So people will compete to offer you Internet access if you use them to route Saito transactions. There are entirely new business models coming. The ISP model will go away once we get massive scale.

“In what ways can Blockchain be implemented alongside other deep-tech like AI and deep-learning?” — Yong Jie

Richard Parris: We have a great example of this in the Cortex project (friends of both TIBA and Saito). What they are doing is using blockchain to provide trust and verifiability around AI assessments, which is really important because it allows for the owner of the data that was analysed to own the result of the analysis. This can overcome a lot of privacy issues, and mean that we, as patients don’t have to give up ownership of our medical data to get treatment. This is a small example, but I think we are only starting to see the start of this kind of thing.

“Given your concerns about the unsustainability of permanent ledgers, what are your predictions for the future of bitcoin? Is its collapse inevitable or can you envisage a way that its scalability problems are overcome?” — Peter Y

David Lancashire: BSV is already saying miners won’t save blockchain data. BCH is putting in “UTXO commitments” (so no-one needs to sync older blocks at all). ETH is already so big it takes 1 full day to sync about 8 days worth of blocks. And BTC is holding the fort, but won’t have the fee volume to pay for security at scale.

Bitcoin could implement the transient chain and that would help. But there are other (worse) economic problems. For me to be optimistic, I’d need a sense that the devs didn’t have their heads in the sand. But everyone is in denial about the problem. In the long-run it won’t matter if bitcoin doesn’t get its act together since alternatives will. And this is at least a 5-year issue, so it isn’t a critical issue making these bad investments today.

“Can you elaborate on what you mean by ‘at scale’?” — Peter Y

David Lancashire: I mean at the limit of what is economically and technically feasible to pay for given the fees collected by the network. In terms of specifics, the nice thing about paying for bandwidth instead of hashing is that you approach technical limits properly. 100 GBPS is reasonably available to large ISP-level actors today. We’re expecting this to increase by an order of magnitude in the next decade. Latency and block-propagation issues aside, that puts the upper limit on a blockchain somewhere around 100 TB today and maybe a petabyte in a decade.

“Context for above question: Couldn’t one argue that bitcoin doesn’t need to ‘scale’ if it functions as a secure settlement network (like the real time gross settlement system used by central banks) rather than an everyday payments system (like Visa and MasterCard)? The former requires a much lower number of transactions making scalability less of an issue.” — Peter Y

David Lancashire: you’re assuming that a small network can be secure… why? Miners won’t burn more in energy than they’re collecting in fees. If the average block contains 50k USD in fees, that means the cost of attack is something like 25k. Who wants to run an international settlements system on a network secured by 2.5k every minute?

This is the single biggest issue we run into with people who are hardcore BTC maximalists. They assume that blockchains are secured by “hashing” or “cryptography” instead of money. So they don’t think about the economics of the network or realize that the block reward that’s buying them security is going to vanish.

Thanks for the follow-up question. hopefully my answer was coherent.

“You say: ‘You’re assuming that a small scale network can be secure… why?’ Because at the current scale at which it operates the bitcoin network is secure, never been subject to a successful 51% attack. The argument is that the current scale of the bitcoin network is sufficient to run a secure real time gross settlement system, with low value transactions taking place on centralised platforms (e.g. a WeChat Pay solution denominated in bitcoin) or second layer solutions like lightning.

“The point about what happens when the block reward runs out is an important one. Correct that transaction fees would have to rise in order to account for the energy expended to mine. However there is real value in secure settlement and this is a service people would be willing to pay for (as they have done historically with gold settlement)” — Peter Y

David Lancashire: Why is your model for how BTC will work in 2029 based on how it has worked when it is printing free money for miners? How is this reasonable?

And tons of POW chains have had 51% attacks. If you think Bitcoin is going to be so secure without the block reward, why aren’t you using those networks? What is the difference between those networks and bitcoin? If the difference is that Bitcoin has more price speculation, that means your entire security model is based on ponzi economics. And that isn’t sustainable.

The BTC crowd talks about Lightning Network a lot, but payment channels like LN will run on all blockchains that are large, scalable and secure. At a minimum, in order to be secure, a small-scale Bitcoin would need to eliminate the 51% attack so that it is protected by 100% of fee volume. If you know a single BTC dev that is working on that… who?

“With incentives, stakeholders often secure decentralized networks, how do you make sure that groups that start with an advantage (by accumulating large stakes at low costs in the beginning or have access to cheap computing power) don’t use it to become dominant players in the network and get more and more rewards and squeeze out small players? How to make sure the network stays decentralized?” — Tristan

Richard Parris: Thanks Tristan. The solution is to not have a monolithic security mechanim like POW and POS. Saito does this by making gathering transaction fees the work that is needed to create blocks. This turns 51% attacks into 100% attacks, because you need to match all the outstanding work as it accumulates. We are actually doing some exciting work at the moment that ensures that attackers have to bleed money under all situations. So if a dominant player attacks that actually leads to more decentralization.

“What are the major merging aspects of quantum computing and blockchain as of today?” — Sun

Richard Parris: The big risk around quantum computing is that earlier cryptography becomes transparent. It does not break or cryptographic techniques. The disparity in the time it takes to create a keypair, and to crack it remains with quantum computing. So we have to increase keysize. Which means we need more scalable networks.

“If you already have Dapps running on your network: (1) What kind of Dapps do you have? (2) How different is the traditional coding vs coding for Dapps (3) What would be a Dapp you’d love to have on Saito but never had the chance or time to develop?” — Cris

David Lancashire:

#1 — Most of our users are spending time in the arcade (//apps.saito.network/arcade). We have a lot of Twilight Struggle players.

#2 — The modules are pretty easy to write. The biggest challenge is getting your mind around the fact that they’re all peer-to-peer (not client-server). So applications run in the browser and updates happen when you receive messages from the blockchain.

#3 – I want a decentralized WeChat that uses group Diffie-Hellman key exchanges to completely avoid the need for centralized server logins. We haven’t coded this ourselves because we’re trying to focus on applications that don’t have chicken-and-egg problems. But I think decentralized, encrypted chat is probably the most important social tool that will come mainstream in the next five years.

We will happily support people building apps on Saito — we’ve got some people in Venezuela who are already building stuff. We have a list of existing modules here and they are pretty easy to code and can show how it is done: //github.com/SaitoTech/saito/tree/master/mods

The weirdest app is probably a hospital login / appointment system for a South American country that has corruption issues and wants blockchain to provide transparency into how normal people get medical care and prevent hospitals from cheating the national payment system.

“You guys have a blockchain-based gaming platform. Could you please tell us about this? Why are so many blockchain companies focusing on gaming?” — Peter H

Richard Parris: Games are a great proving ground. Our reasons for putting games on testnet are probably quite different from other projects. We are really keen to demonstrate Saito’s ‘industrial strength’ and simplicity of development. Games like Twilight Struggle are incredibly complex and require interactions that would melt the vm on smart contract systems. It also contains every kind of interaction that might be needed in enterprise software. Coding games like that let us build a community with something they really value and is fun, test our testnet, and demonstrate just how powerful Saito is.

“Consensus mechanisms: proof of work/stake/authority/time etc. Which ones do you think are most promising and which do you think will not be relevant in the future and why?” — Tristan

Richard Parris: There is a lot of work going into new consensus. Unfortunately, I have not seen any that are grappling with the fundamental issue for blockchain — paying everyone in the network for the value they provide. Some Proof of Space protocols are concentrating on paying for storage, but they fail to pay for bandwidth for access. Most ignore the problems entirely and concentrate on optimizing smaller problems.

“You are involved with both Chinese and overseas blockchain communities (industry, academia, investors, users). What are the main differences? — Peter G

Richard Parris: My blockchain life started in China, and it was amazing when I started traveling for Saito to conferences in the US and Europe how different things were. To caricature things: the US is ‘land of ETH’ certainly of POS. Everything is a development problem waiting to be solved and blockchain will take over the world. Concerns are around privacy and social goods. Asia, and particularly China, is very pragmatic. Finance-driven, but interested in how blockchain works, and exploiting that. Ever since my first Beijing Bitcoin meetups in 2013/14 when visitors from the US were stunned at the number of attendees that actually worked in bitcoin, I have felt that the rest of the world is catching up.

“In your opinion, what will it take for blockchain to gain widespread acceptance & implementation?” — Yuqian

David Lancashire: I think Saito will make blockchain mainstream. First because we are seeing actual adoption from people who want to use the applications we have (mostly the games) and who don’t know that we are even a blockchain, or care. Second because “smart contracts” are not suitable for most apps and these other networks require people to buy tokens to use them. Not only are the regulatory issues massive here, but you can’t get someone to buy tokens to use your service unless you have a really compelling service, and most business cases that can do that already exist off-chain.

In Saito, the token distribution happens through use — people will earn tokens JUST USING the network. So we have an economic model that will pull in users and pay them for adoption. The fact that the network also pays for routing means there is a great business model for developers too — people who build applications that people want to use can get paid with the tokens they are getting issued.

“How to prevent a large group of people/bots with similar intentions controlling block chain branches and change/erase/edit the chain?” — 张心旭

Richard Parris: In POW it is possible for attackers to orphan other people’s work. In Saito, transactions that are not included in a block can be included in the next, so censoring transactions becomes harder. Re-writing the chain is also more difficult, since rewriting history means creating a chain with more value than the chain you are replacing. And any transaction that is excluded is still valid, and can be added to the end of the new chain.

David Lancashire: I’d suggest thinking about why this problem exists, because it goes to the heart of one of the most important things that makes Saito different from any other blockchain:

1. POW and POS chains make it “difficult” to produce blocks, and then give all of the money to whoever can produce 51% of the blocks. So the networks incentivize collusion. People are more profitable if they team up.

2. Saito recognizes that, “all forms of difficulty can be reduced to spending money, so what we do is just make sure it is ALWAYS EXPENSIVE” to attack the network. Attackers need to spend their own money to attack the chain. BUT this property holds above the 50% mark.

Attackers will always lose money through the payment lottery. So if a node or group of nodes does 80% of the routing work, it will still cost them 20% of the network’s transaction fee volume with every block they produce.

That guaranteed loss is what creates the “cost” of re-writing the chain — but is also means that there are no incentives for collusion like in POW or POS, where a big enough group can attack the network for profit.

Essentially, by solving a different problem than POW and POS, Saito provides the same guarantees without the 51% attack. We can calculate the cost of attacking the chain, and wait the appropriate number of confirmations. The network is way more secure though, since it doesn’t fall apart once you have 50% of block production capability.“I’m gonna have ey cannot fake.

Last question: where does the name Saito come from? ?— Peter G

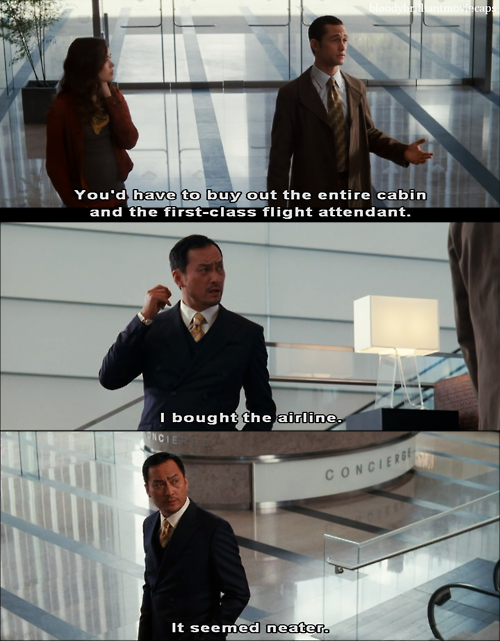

Richard Parris: Saito is one of the leads in Christopher Nolan’s masterpiece Inception.

Here we see an example of how Mr Saito solves a problem at a deeper level. That’s what we are all about.

David Lancashire: There are a lot of interesting parallels too, not least the plans for global airline acquisition. One of the things I really like about the film is that it teaches us that you have to solve problems on the deepest level. And that is what Saito does. Most blockchains don’t try to fix the economics. People just give money to block producers, tweak that process, maybe add some volunteers somewhere (validators! masternodes!) and call it a day. Saito looks at the economics and says, “the problems are that we’re not incentivizing the right things.” And then it fixes those issues. It’s like fixing things on the lowest dream level, and watching the “higher up” problems like the 51% attack just melt away.

Also, Inception is a great film.